Getting served with a credit card lawsuit doesn’t have to spell financial disaster. Modern technology has revolutionized legal defense, with AI tools that can analyze case law, identify procedural errors, and generate effective legal arguments that increase dismissal chances by up to 40%.

These digital weapons can expose creditor mistakes, challenge invalid claims, and automate complex legal processes that once required expensive attorneys. Smart defendants are turning their smartphones and computers into powerful defense systems.

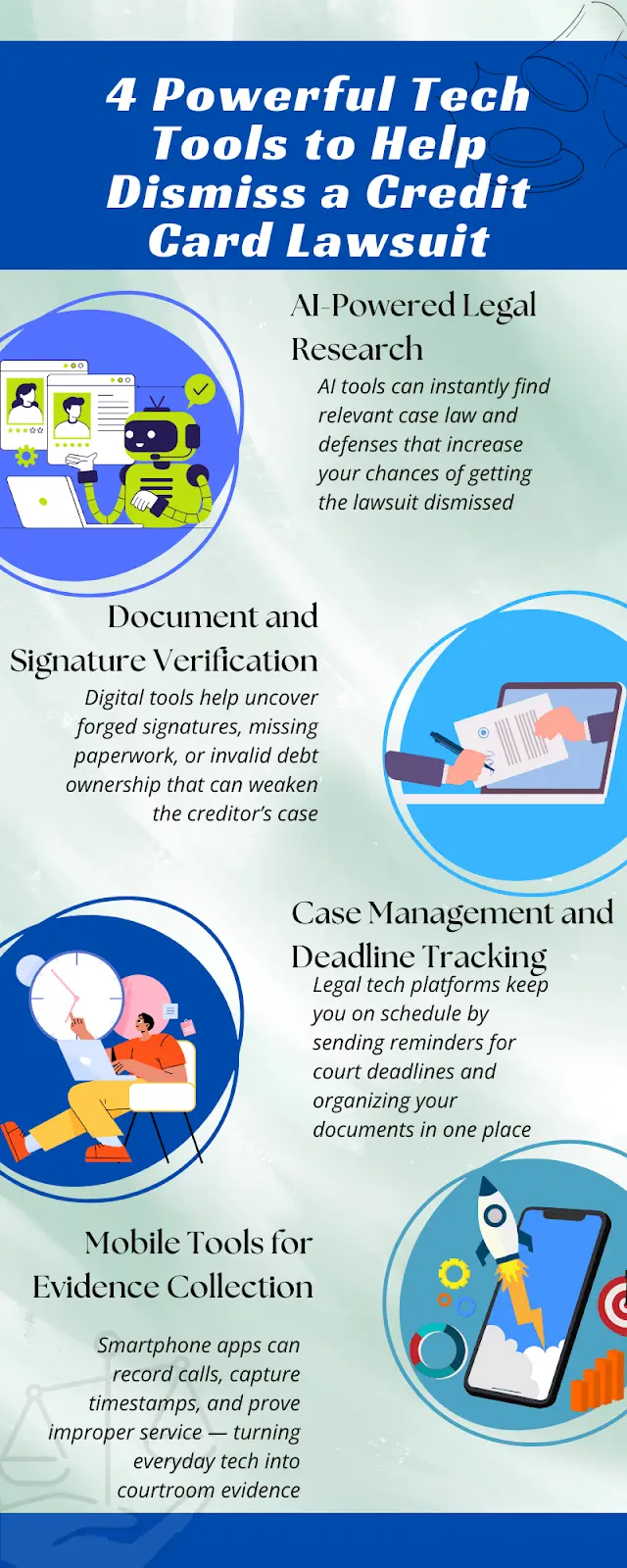

Essential Tech Tools for Credit Card Lawsuit Dismissal

Technology transforms how ordinary people fight back against aggressive creditors. These digital platforms level the playing field between you and well-funded collection firms.

AI-Powered Legal Research Platforms

Westlaw Edge AI and Lexis+ AI have democratized legal research that was once exclusive to law firms. These platforms use machine learning to scan thousands of similar cases, identifying winning arguments and procedural defenses. You can discover how other defendants successfully challenged creditor standing or statute of limitations violations.

If you’re looking into how to get a credit card lawsuit dismissed, you’ll find that modern strategies rely heavily on these AI research tools. They’ll highlight relevant case law and suggest specific motions that worked in similar situations.

Document Analysis and Discovery Software

eDiscovery platforms help organize mountains of financial paperwork that creditors often mishandle. OCR technology converts old paper statements into searchable digital files, making it easier to spot inconsistencies in creditor claims.

Blockchain-based authentication tools can verify whether signatures on contracts are genuine. Many credit card lawsuit dismissal cases succeed when defendants prove forged or manipulated documents.

Case Management Systems for Legal Defense

Cloud-based platforms track critical deadlines and court requirements automatically. Missing a response deadline is the fastest way to lose your case, but these systems send alerts days before filings are due.

Client portals provide real-time updates on case progress and store all documents securely. This organization becomes crucial when building your defense strategy.

Digital Evidence Gathering Strategies for Defending Against Credit Card Lawsuits

Evidence collection has gone digital, giving defendants powerful new ways to challenge creditor claims. These tech solutions for legal issues can expose weaknesses in the creditor’s case.

Electronic Signature Verification Technology

Metadata analysis tools examine digital signatures for authenticity markers that human eyes can’t detect. Many credit card agreements contain forged electronic signatures that sophisticated software can identify.

Digital forensics platforms analyze timestamping and audit trails to prove when documents were signed. This technology often reveals that creditors backdate agreements or alter terms after signing.

Financial Data Analytics Platforms

Credit reporting software identifies inaccuracies in creditor claims by cross-referencing multiple databases. Statistical analysis tools help challenge inflated balances or incorrect interest calculations.

AI-driven pattern recognition spots fraudulent claims by comparing your case to known scam patterns. These platforms flag suspicious creditor behavior that strengthens dismissal motions.

Mobile Apps for Real-Time Evidence Collection

Voice recording apps capture creditor phone calls that violate debt collection laws. Many states allow single-party consent recording, making these apps legal evidence goldmines.

Photo documentation tools timestamp legal notices and create tamper-proof records. GPS tracking apps verify whether process servers visited your address, challenging improper service claims.

Credit Card Debt Lawsuit Strategies Using Legal Tech

Strategic technology deployment can systematically dismantle creditor cases. Companies that implement effective communication strategies see a 47% higher total return to shareholders over five years, proving that structured approaches deliver measurable results.

Automated Debt Validation Processes

Digital demand letter generators create legally compliant validation requests that force creditors to prove their claims. These templates include specific language that triggers creditor disclosure requirements under federal law.

Online debt verification systems track creditor responses and identify failures to provide required documentation. When creditors can’t validate debts properly, dismissal becomes much more likely.

Statute of Limitations Calculators

When it comes to how to get a credit card lawsuit dismissed, state-specific automated tracking calculates exact deadlines for different debt types. Credit card debt lawsuit strategies often focus on expired statutes of limitations that creditors hope defendants won’t notice.

AI-powered deadline analysis accounts for payment history and state law variations. Integration with court filing systems ensures you raise time-barred defenses properly.

Jurisdictional Challenge Tools

Venue analysis software determines whether creditors sued in the correct court location. Many collection firms file in convenient locations rather than legally proper venues.

Service of process verification platforms document improper legal service that invalidates lawsuits. Digital jurisdictional databases help identify when creditors lack standing to sue.

Advanced Tech Solutions for Legal Issues in Credit Card Cases

Cutting-edge technologies provide sophisticated defending against credit card lawsuits capabilities that rival expensive legal teams. These tools represent the future of legal defense.

Artificial Intelligence Legal Assistants

ChatGPT and Claude assist with legal research and motion drafting when properly guided. AI-powered tools analyze case facts and suggest relevant legal theories for dismissal motions.

Predictive analytics examines judge behavior patterns and case outcomes to optimize legal strategies. These insights help defendants understand which arguments are most likely to succeed.

Virtual Reality Court Preparation

VR platforms simulate courtroom environments for practice presentations. Mock trial simulations help defendants prepare for hearings and improve their confidence.

3D visualization tools create compelling timelines of financial transactions that expose creditor errors. Immersive practice sessions significantly improve courtroom performance.

Blockchain Analysis Tools

Cryptocurrency forensics tracks digital payment histories that creditors often misunderstand. Smart contract analysis reveals automated payment disputes that support dismissal arguments.

Blockchain transaction verification provides tamper-proof evidence of payment histories. These tools are particularly valuable for tech-savvy defendants with digital payment records.

Your Digital Defense Victory

Technology has fundamentally changed how ordinary people can fight credit card lawsuits successfully. From AI research assistants that rival law firm resources to blockchain tools that expose creditor fraud, these digital weapons provide unprecedented defense capabilities. Smart defendants who embrace these technologies don’t just survive lawsuits—they win them.

The future belongs to tech-savvy defendants who understand that smartphones and computers can be more powerful than expensive attorneys when properly deployed.

Your Tech Defense Questions Answered

What are the three things debt collectors need to prove?

Debt collectors must prove three key things: that the debt is yours, that the amount is correct, and that they have the right to collect it. If they can’t, they’re not allowed to continue pursuing you for payment.

Can free legal apps help dismiss lawsuits?

Yes, many free apps provide legitimate legal assistance. Document organization apps, deadline trackers, and evidence collection tools cost nothing but deliver real value in building your defense case.

How quickly can tech tools identify dismissal opportunities?

AI research platforms can scan thousands of cases in minutes, identifying potential defenses within hours. Traditional research might take weeks, but technology compresses this timeline dramatically for faster case preparation.

Also Read-Practical Ways to Reduce Stress in Today’s High-Speed Life