Stepping into the world of online trading can feel like navigating uncharted waters, full of promise yet demanding precision. Maverix Global positions itself as a beacon for both emerging and seasoned traders, promising a seamless fusion of global market access, state-of-the-art technology, personalized guidance, and bank-grade security.

In this detailed Maverix-Global.com review, we take a closer look at how the platform blends powerful features with trader-first functionality, without the learning curve typically found on institutional-grade systems.

A Unified Portal: Opening Doors to Diverse Markets

From its sleek dashboard to its modular interface, Maverix Global aims to collapse the traditional barriers between asset classes. Rather than forcing traders to juggle multiple platforms or data feeds, Maverix Global aggregates:

- Equities (major indices and single-stock CFDs)

- Commodities (gold, oil, agricultural staples)

- Currencies (majors, minors, exotic pairs)

- Cryptocurrencies (Bitcoin, Ethereum, and a curated selection of altcoins)

This consolidation simplifies portfolio diversification: you can pivot from analyzing a currency pair’s volatility one moment to charting oil’s response to geopolitical headlines the next, without ever leaving the platform. That uninterrupted workflow is a cornerstone of Maverix Global’s user-centric ethos.

Key Features Explored

1. Global Market Access

Rather than restricting traders to a narrow subset of instruments, Maverix Global grants exposure to over 600 tradable instruments spanning four asset classes. Whether hedging inflation concerns with gold, speculating on a tech stock’s quarterly earnings, or capitalizing on crypto’s price swings, the platform’s unified order entry system keeps execution quick and intuitive.

Multi-asset access also means you can implement cross-market strategies—like pairs trading between a stock index and its derivative futures—directly through a single account interface.

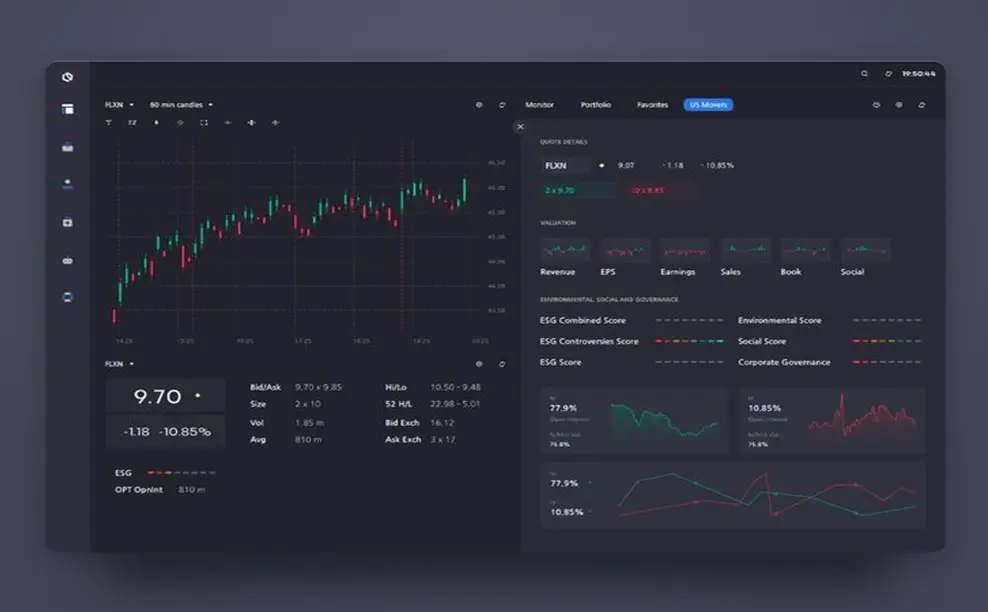

2. Advanced Technology

- Execution Speeds: Leveraging co-located servers and optimized routing, Mavericks Global boasts sub-millisecond order execution in many major markets. That rapid fill rate can be a difference-maker for high-frequency or scalping strategies.

- Tight Spreads & Low Fees: Starting spreads from as low as 0.1 pips on major currency pairs, coupled with transparent commission schedules, help contain trading costs.

- Robust Analytics: Embedded charting features include dozens of technical indicators, heat-map overlays, and even custom scripting capabilities for algorithmic traders. Real-time news tickers and sentiment gauges are woven directly into the chart interface, ensuring key data never feels siloed.

This combination of technical precision and interface fluidity is frequently highlighted in any Maverix-Global.com review for its ability to support both discretionary and algorithmic trading workflows.

3. Personalized Services

Maverix Global recognizes that no two trading journeys are identical. Beyond the standard help desk, the platform offers:

- Dedicated Account Managers: One-on-one specialists who review your trading style, suggest relevant resources, and coordinate bespoke research requests.

- Tailored Strategy Sessions: Whether you’re refining a breakout system or exploring mean-reversion tactics, these sessions connect you with in-house analysts to fine-tune your approach.

- Priority Event Invitations: From market outlook webinars to small-group Q&A seminars, Maverix Global’s calendar is peppered with interactive experiences designed to accelerate your learning curve.

4. Secure Trading Environment

Security isn’t an afterthought at Maverix Global—it’s woven into the very architecture:

- Data Encryption: AES-256-bit encryption secures all data transmissions, matching protocols used by leading financial institutions.

- Two-Factor Authentication (2FA): Mandatory 2FA at login and withdrawal ensures account integrity even if credentials are compromised.

- Regulatory Oversight: Operating under licenses from recognized bodies (e.g., FCA, VFS), Maverix Global implements strict segregation of client funds and undergoes regular audits, giving traders peace of mind that their assets are held with institutional rigor.

Navigating the Platform: A Hands-On Perspective

Upon first login, you’re greeted by a customizable workspace where widgets—charts, watchlists, order books—can be rearranged via simple drag-and-drop. A subtle dark-mode theme reduces eye strain, while keyboard shortcuts streamline everything from placing orders to toggling between timeframes.

Account verification follows a three-step workflow (ID upload, proof of address, and account questionnaire), typically completed within 24 hours. Once approved, the real-money sandbox unlocks, granting full access to live markets. For those not yet ready to commit capital, the “Test Drive” demo account mirrors real-world conditions, complete with virtual funds and real-time quotes.

Deep Dive: The Analytical Suite

For traders craving depth, Maverix Global’s analytics pack delivers:

- Advanced Charting Module: Over 100 indicators, Fibonacci retracements, Elliot-wave overlays, and a dedicated drawing toolbar for annotating patterns.

- Backtesting Environment: Integrated into the platform, you can test custom Expert Advisors (EAs) against decades of historical data, across multiple instruments and timeframes.

- Real-Time Alerts: Price-level, indicator-cross, and news-triggered alerts can be delivered via SMS, email, or in-platform pop-ups.

- Sentiment Dashboard: Tracks aggregated client positioning, social-media sentiment, and volatility indices, helping you gauge when crowded trades may be ripe for a contrarian approach.

Together, these tools transform raw market data into actionable intelligence—whether you’re a discretionary trader or an algo-driven strategist.

Client Support & Educational Ecosystem

Beyond a standard FAQ page, Maverix Global invests heavily in trader education. It’s one reason many seasoned traders mention in a Maverix-Global.com review that the educational access grows with you—not just in quantity, but in relevance to your current trading tier.

- Academy Library: Dozens of e-books and whitepapers covering fundamentals (leverage, margin) through advanced topics (order flow, risk segmentation).

- Video Tutorials: Short-form modules demonstrate platform features, technical analysis concepts, and risk-management techniques.

- Live Webinars & Seminars: Hosted multiple times per week, these sessions pair market experts with interactive Q&As, fostering direct dialogue on emerging trends.

- Glossary & Market Guides: A searchable glossary decodes financial jargon, while in-depth guides explore each asset class—commodities, indices, FX, and crypto—in turn.

This multi-tiered support network ensures traders can self-pace their learning or lean on live instruction when tackling complex strategies.

Account Types Demystified

Maverix Global crafts account tiers around distinct capital requirements and service levels:

| Account Tier | Min. Deposit | Leverage | Signals/Week | Key Perks |

| Test Drive | $5,000 | 1:100 | 5 | Demo funds, basic educational access, manager intro. |

| Standard | $15,000 | 1:100 | 29 | Monthly tips, senior manager guidance. |

| Plus | $35,000 | 1:200 | 131 | Webinars access, analyst consultations, swap discount. |

| Gold | $75,000 | 1:400 | 270 | Personalized meetings, 25% swap discount. |

| Expert | $155,000 | 1:400 | Unlimited | Secret groups, weekly analyst sessions, insurance. |

| Platinum | $250,000 | 1:600 | Unlimited | Daily strategy calls, trading room access. |

| Millionaires Club | Invite only | Custom | Custom | VIP events, bespoke trading strategies. |

This tiered approach allows traders to align account features with their capital base and desired level of support, pivoting easily as portfolios and ambitions grow.

Markets at a Glance

Maverix Global’s four flagship markets each offer unique dynamics:

- Commodities

- Indices

- Currencies

- Cryptocurrencies

By grouping these disparate markets under one roof, they remove friction and grant traders the freedom to pursue cross-asset strategies—like hedging equity exposure with a currency pair or speculating on oil’s reaction to central-bank decisions. This cross-market flexibility is often underscored in nearly every Maverix-Global.com review as a core strength that supports hybrid trading strategies with minimal friction.

Promotional Landscape

Maverix Global sweetens the trading journey through periodic incentives:

- Dragon Year Cashback: Up to $10,000 cashback and 4.5% p.a. interest on qualifying balances during Lunar New Year.

- Deposit Credits: Tiered bonuses for new deposits, encouraging active trading.

- Refer-a-Friend: Earn up to $200 per successful referral.

- Seasonal Bonuses: Holiday campaigns offering reduced spreads or bonus credits.

- Loyalty Tiers: As cumulative trading volume climbs, traders unlock perks—priority support, VIP networking events, and deeper swap discounts.

- Trading Challenges: Leaderboard contests with cash prizes, fostering community engagement, and skill development.

These promotions add occasional bursts of value, without overshadowing the platform’s core strengths.

To Wrap Up

The platform we reviewed marries breadth of market access with depth of technology and personalized service, crafting a multi-dimensional trading ecosystem that adapts to evolving skill levels and portfolio sizes. From sub-millisecond execution speeds to bespoke analyst consultations, the platform balances institutional-grade infrastructure with a human touch.

As global markets continue to shift beneath our feet, having a versatile, client-centric portal like Maverix Global can be the compass that keeps your trading voyage on course—and as shown in this Maverix-Global.com Review, it’s a platform built not just for today, but for the evolving demands of tomorrow.